87. Let's Put the Screws to Highdive (Chicago)

A Snapshot of Who Your Agency Is Not.

Greetings and Salutations.

If you would do me the favor of sharing this newsletter with 10 people you can’t stand I would greatly appreciate it. Here’s the freaking button.

Let’s dig in, shall we?

Let’s Give Highdive (Chicago) the Treatment.

Clickbait (kinda).

Highdive is making the big boys lose sleep, outperforming them in block-and-tackle basics of delivering broadcast laughs that delight clients and move the needle.

Sure, they inherited State Farm creative. And “Jake from State Farm” is a bit long in the tooth. And Eli Manning is keeping Jersey Mike’s fresh with Danny Devito, but this one may need Peyton to make it a Manning brothers show.

Highdive seems pretty comfortable and confident with letting the big boys lose their sh*t over figuring out AI. As for now they appear focused on cha-ching with great brands, and growing.

What the Numbers Tell Us.

The Campaign US 2025 Agency Performance Review gives Highdive a pretty solid summary picture:

Revenue grew from ~$32M in 2023 to $42M in 2024.

Growth rate is accelerating — 31% growth in 2024 vs 24% the year before.

They landed some big-name wins: KFC, Culligan, Dish Network, Lay’s, MSC Cruises, State Farm, etc.

Their talent turnover is very low, 7% in 2024.

On diversity: 53% of their staff is female, and 67% of their C-suite are women.

Highdive seems to be thriving, not crumbling. Their business looks healthy, they’re winning big clients, and its leadership/staff stability is solid. Nothing tragic there; at least publicly.

They’re Playing Super Bowl Bingo.

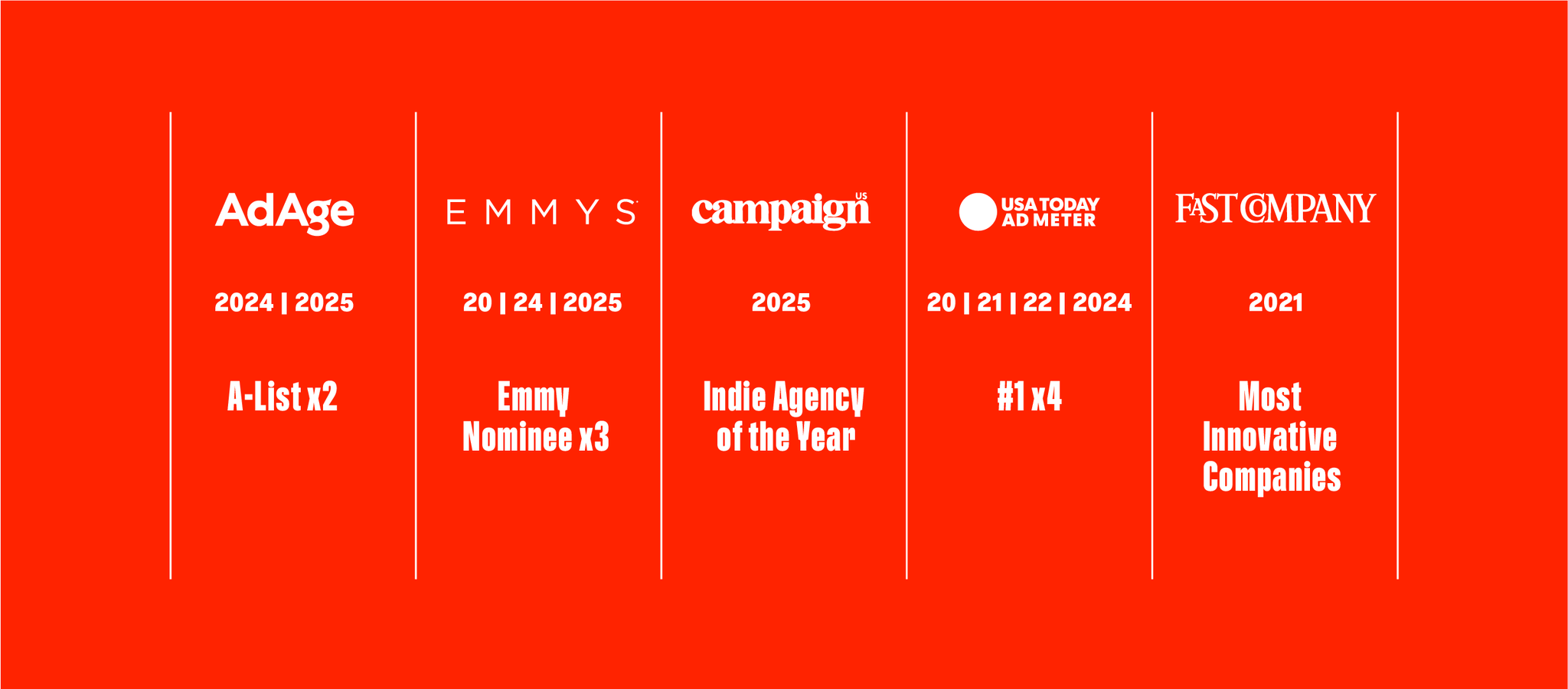

Highdive has built an absolutely dominant Super Bowl track record that’s pretty much unmatched in the industry. They scored #1 on the USA Today Ad Meter three consecutive years starting in 2020 Adweek ; first with Jeep’s “Groundhog Day” featuring Bill Murray Ad Age, then grabbing both the #1 and #2 spots in 2021 for Rocket Mortgage Adweek, followed by another #1 in 2022 with a Barbie-themed Rocket Mortgage spot Ad Age (with Lay’s landing at #6 that same year Adweek).

They came back in 2024 with another #1 for State Farm featuring Schwarzenegger and DeVito NBC ChicagoCampaign Live, plus a BetMGM spot with Tom Brady and Vince Vaughn. Most recently, their Lay’s commercial with Taika Waititi hit #2 in 2025 Indie Agency News. That’s four #1 rankings and consistently top-10 finishes, a ridiculous streak that makes them the agency whose work everyone’s watching on game day.

They are experiencing success mixed with, not just growth, but high-profile growth. On the Batman/Bateman spot, Jake as Robin was a missed opportunity. And Jason Bateman was award-winning worthy. But the real heroes are the ones who got DC Studios on-board for this. And execution was perfection.

There’s No Place Like Home.

Talent-wise, it’s a cozy place, with only 7% voluntary turnover in 2024. Must be casual Friday’s. And again, women make up 53% of the team, 67% of the C‑suite. Yes, they’re not just hiring for the optics.

They also claim they used AI in 2024, but only to “enhance” creativity, not to replace humans. Very “teammate, not takeover” vibes.

**Web Edit** - a subscriber was lightning-fast blazing quick to point out Highdive wrapped a two-minute Gen-AI social project for client Jeep.

Animals share wild thoughts about new 2026 Jeep Grand Cherokee.

Growth, Big Clients, Talent, and Inclusion.

In other words, Highdive is doing the pretty-much-everything-right routine: killing it on growth, scooping up big clients, locking in talent (with very low churn), and running a C-suite that’s not just a boy’s club. They’re doing the kind of thing that gives Big Holding Co. execs lower abdominal discomfort.

They’re independent AND winning big. If we’re measuring by “not crashing into a dumpster fire,” Highdive is doing donuts in the big agencies’ front yard while the big boys are still looking for their car keys.

What Could Be Lurking Behind the Highdive Hype

Private Equity Pressure

In May 2024, Svoboda Capital made a “significant investment” in Highdive. Svoboda Capital

With PE money in the mix, there’s always the risk of profit pressure. High-growth is great, but PE typically comes with expectations: scale fast, deliver return, maybe streamline.

If Highdive doesn’t hit aggressive growth or margin targets, that could stress both leadership and the “healthy relationships” ethos they brag about.

Office Expansion Risk

They’re doubling down on real estate: Highdive subleased 26,000 sq ft in the Merchandise Mart doubling their footprint. The Real Deal

That’s a bold move for any agency. If growth slows or client churn happens, that extra office cost could become a drag. It’s a bet, and big real estate bets in adland can go sideways.

Revenue Sustainability

While Highdive claims very strong organic growth (listed above), they declined to disclose how many total clients they have or all of their new business billings. Campaign Live

Not knowing how deeply diversified their client base is makes it harder to assess churn risk. If a few big clients make up a big piece of revenue, losing one could hurt.

Strategic Leadership Risk

They just brought in Nimisha Jain as Chief Strategy Officer. MarComm News That’s a big hire, and it signals a shift; likely doubling down on strategy, growth, and bigger-client relationships.

But if internal pressure (from PE or scale ambitions) forces the agency to move too far from its “healthy, creative-first” roots, culture could be strained.

Growing Overhead / Talent Load

According to Ad Age, Highdive added ~37 employees in 2024 and is scaling its in-house production shop (1986 Studios). Ad Age. 150-ish nowadays?

More people, bigger office, more production capacity = more fixed costs. If they don’t land enough high-margin work to justify that overhead, profitability could suffer.

Creative Risk Is Not Enough

Highdive makes a name for itself with big creative stunts (Super Bowl spots, etc.). But creative brilliance doesn’t always equate to stable retainer work.

If their business keeps leaning on “big splash” campaigns versus recurring, stable engagements, they may be exposed to swings in demand or client priorities.

But in Advertising, Risk = Opportunity.

Highdive is making aggressive bets: on growth, on office, on talent, on scale. But they’re backed by PE, and they’re scaling fast. If they don’t manage their costs or maintain consistent client depth (not just headline-grabbing wins), they could have issues.

That said: nothing publicly points to a crisis right now. These are risks, not known failures. But in advertising, risk = opportunity.

The Upshot

Highdive is not a charity case. They’re growing fast, winning big clients, producing culturally memorable work, and keeping their team relatively stable.

They’re making high-stakes bets: on real estate, on scale, on leadership.

If things get rough, it won’t be because they weren’t smart; it’ll be because scaling in adland is really hard when you’re trying to preserve your identity.

The risk is real and that’s exactly what makes Highdive interesting (and dangerous to their bigger, more buttoned-down rivals).

Big Finish.

Highdive is kicking ass, and the rest of the indie‑agency world should take notes (or be mildly terrified). And this during a time where the Big Boys are absolutely melting down.

Highdive isn’t just surviving. They’re balling. They’ve got the growth, the clients, the culture, and the capital to back it all up. If you’re looking for an indie agency that’s not just talk but real traction, these are your people. Big agencies, watch your mirrors Highdive’s starting to look huge.

Happy Thanksgiving everyone!

Feel free to leave comments and feedback.

Web Only:

Work samples at https://highdiveus.com

Go deep on their Vimeo channel: